- Kanalning o'sishi

- Post qamrovi

- ER - jalb qilish nisbati

Ma'lumot yuklanmoqda...

Ma'lumot yuklanmoqda...

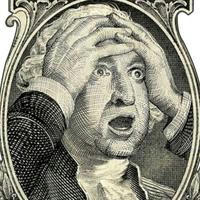

Examine the World Economic Forum's campaign for Central Bank Digital Currencies (CBDCs), a cashless world, and financial privacy and independence.

3010

Examine the World Economic Forum's campaign for Central Bank Digital Currencies (CBDCs), a cashless world, and financial privacy and independence.

4710

Starting September 1, Russia will enforce a strict ban on crypto to reinforce the ruble. The ban exempts crypto miners and Central Bank test projects.

12240

David Walker, former Comptroller General, said recent economic data should prompt lawmakers to take action. The IMF warned the U.S. that government spending and increasing national debt are not sustainable.

11000

20430

23562

245150

23150